Wait for Mortgage Rates to Fall or Buy Now?

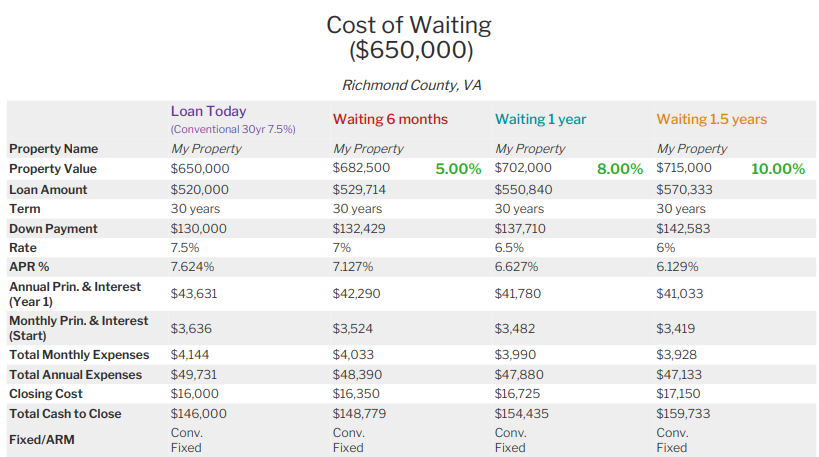

In today’s real estate landscape, mortgage rates have been on the rise, causing some prospective homebuyers to contemplate delaying their plans. But, is this really the smartest strategy? We’ve partnered with lender, Rob Rudd, in Richmond, VA, to shed light on the numbers. Let’s explore whether it’s better to buy now and benefit from home appreciation, or wait for lower rates that might not come anytime soon.

Understanding the Mortgage Rate Situation

Mortgage rates have indeed experienced an upward trajectory in recent times. They are undeniably higher than the record lows we’ve seen, but in the broader context, they are still remarkably favorable for homebuyers.

The Compelling Case for Buying Now

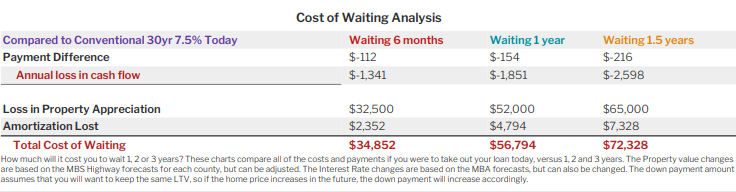

The central question is whether you should seize the opportunity now or wait for rates to drop. To assist you in making an informed choice, take a look below at a concise analysis centered on home appreciation and the hidden costs of waiting for those lower rates.

Here’s why the numbers strongly advocate taking action now:

- Home Appreciation: Real estate is known for its appreciation over time. By purchasing a property now, you’re positioning yourself to benefit from potential equity gains as the market continues to appreciate.

- Rate Predictability: While there’s hope for lower rates, there’s no certainty they will drop significantly in the near future. Waiting indefinitely could result in missing out on the current favorable rates.

- Long-Term Interest Costs: Waiting for lower rates could lead to increased long-term interest costs. Even a modest increase in rates can substantially affect the overall amount you pay over the life of the loan.

- Opportunity Cost: If currently renting, delaying your home purchase means paying more in rent rather than investing in your property, building equity, and enjoying the advantages of homeownership.

- Equity Building: Every mortgage payment made now is a step toward building equity. Waiting means postponing the opportunity to accumulate equity in your own home.

While concerns about higher mortgage rates are legitimate, the financial analysis tells an intriguing story. Waiting for rates to fall may not be as financially prudent as it initially appears. The prospect of purchasing now, with all the associated benefits, including home appreciation and today’s historically low rates, is a compelling argument for taking action.

To gain a more personalized understanding of how these scenarios apply to your situation, we strongly advise consulting with a knowledgeable lender. They can offer tailored guidance based on your unique financial situation. Contact Rob Rudd using the information below.

The information contained in the article has not been prepared by Fairway Independent Mortgage Corporation and is distributed for educational purposes only. The information is not guaranteed to be accurate and may not entirely represent the opinions of Fairway Independent Mortgage Corporation. This is not an offer to enter into an agreement. Fairway does not guarantee a mortgage loan will result in equity gains or tax advantages. Any potential benefits from homeownership are based on individual factors. Contact your Fairway loan officer for more information regarding your specific situation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link